Brookings economist Ron Haskins puts a hurt on some numbers in this AM's Washington Post.

His piece has two parts. The first part, discussed below, has a pretty fat thumb on the scale. The second is about how decisions regarding marriage and the pursuit of higher ed can have a profound effect on a person and family's economic success. I'll leave that for now, though I should say that while I don't often agree with him, Ron's done solid, thoughtful work on those important issues.

Which is one reason why the rest of the piece struck me as uncharacteristically misleading. Let's go piece by piece.

- The argument is framed as "the myth of disappearing middle class." That's a canard. Most living standards analysts, including Ron in this piece (!), think of the middle class as some chunk in the middle of the income distribution -- say the middle fifth or some variation there in (e.g., 40th to 80th percentile), which of course cannot by definition "disappear." I've been writing about middle-class economics for decades, including nine editions of the "State of Working America. Not once did I or my colleagues argue "disappearance."

- We did, and do, argue that the wage and income growth of middle class workers and families has weakened over time-that the middle-class has becoming increasingly squeezed. How does that square with Ron's findings? He cites research much like that of the Congressional Budget Office on family income trends, noting that middle class income (the middle fifth of the income scale) "grew by nearly 40 percent" 1979-2007 (CBO analysis shows 35%; Ron's source shows 37%, so about the same -- I'm using CBO because it's available to me in some detail; note that these trends include the effect of taxes, transfer payments, and the value of employer provided health care).

First of all, 35% over 28 years is 1.1% per year, over a period when productivity grew at twice that rate (up 72%, or 2% per year). There's no reason to expect middle-class incomes to grow at the rate of productivity year in and year out, though they did so for a few decades in the post-war years. But this persistent divergence is important context that should not be left out.

- The value of health care isn't as big a deal as he thinks it is, though it's characteristic of this "myth" literature to invoke the value health benefits as a game-changer for middle-class living standards. This raises two questions. First, are such benefits totally fungible? That is, if the value of my employer or government provided health care benefits is $1,000, is my family that much better off?

It's not clear that this is the case, especially given the fact that the rising costs of health care don't always reflect quality improvements for the broad middle class (i.e., they have more to do with technology and end-of-life care). It's certainly not worth zero -- to go without health coverage is a real blow to living standards. And if you or your family gets sick, it's extremely valuable. But it's wrong to just tack it onto income and argue everyone is that much better off.

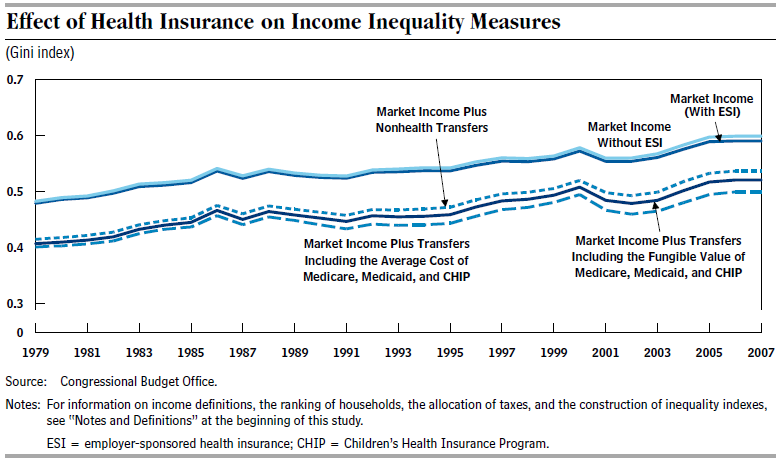

Second, what's the empirical evidence here? On inequality, as the figure below reveals, there's little difference in the trend of the Gini coefficient (a measure of income inequality) when you include the value of employer-provided care (see the lines labeled market income with and without ESI -- employer-sponsored insurance). The two lines are almost coincident, meaning the increase in inequality doesn't go away when you include the value of health care.

In terms of real growth, it turns out that taxes matter much more than the value of health care. The CBO data show that real median income, all in (taxes, ESI, etc.), grew 35%, 1979-2007, as noted. Take out taxes and transfers (and it's taxes that are the big story for the middle, not transfers), and that growth falls by almost half, to 19%, or 0.6% per year. More on that in a moment, but woe betide the middle class-or anyone else-if the fate of their living standards is tied not to economic growth or their labor market outcomes, but to the largess of the Congressional tax writing committees.

- It's also wrong to lump all these time periods together (note: this is a mistake that Ron's source data -- a paper by Rick Burkhauser et al doesn't make -- they break growth periods up in useful ways). About 80% of that 19% growth in pretax income occurred in the 1990s expansion (1993-2000), a period of uniquely full employment, and the only period over the last thirty years when the middle class kept up with overall economic growth. Over the 1980s business cycle, market incomes for the middle class grew 5%; in the 2000s cycle, a measly 3%.

- To understand the middle class squeeze, you've got to look and wages and hours. Census data reveal the amazing fact that the median earnings of full-time male workers were almost exactly the same in real terms in 1979 as in 2010: in real 2010 dollars, 1979: $47,621; 2010: $47,715. How could that possibly not be relevant in an article about middle-class well-being?

Because of this long-term stagnation in men's earnings, middle-class families have had to work a lot more hours to get ahead. Of course, women's contributions to their families' incomes have become much more important over these years, and that too needs to be accounted for, as EPI does in State of Working America. There you'll find evidence of 3-4 more months spent in the paid labor market by married-couple families over this period.

That's not all bad, of course, and partially reflects women's integration into the job market as well as the decline in gender wage differentials. But you can't ignore it, tack on taxes and health care, and wash your hands of any possible problems here.

In fact, if you include these observations about wages to Ron's thesis here, you're left with a pretty uncomfortable conclusion: the middle class doesn't need to worry about how they're doing at work -- we'll make up any shortfalls with tax and health benefits.

Good luck with that.

As I said, a lot of what Ron has in here makes more sense than this "disappearing middle" stuff. He's got good evidence of the importance of increased benefits to the poor, which as we at CBPP have also stressed, have often been very effective at lifting the incomes of the bottom fifth (especially the EITC). But the part on the middle class is incomplete at best and misleading at worst.

This post originally appeared at Jared Bernstein's On The Economy blog.

?

Source: http://www.huffingtonpost.com/jared-bernstein/middle-class-economy_b_1391584.html

pacquiao marquez penn state game radiohead tour cbsnews ufc on fox fight card florida marlins boise state football

No comments:

Post a Comment